Trucking is a constantly increasing and lucrative business. That’s why it is also highly competitive, especially if you are starting a trucking company.

LEARN 12 SECRET STEPS HOW TO MAKE $950 MORE PER TRUCK / MONTH

Hey! I'm George J.Magoci and I will send you a FREE eBook where you can learn 12 secret steps how to make $950 more truck/month.

To stay in front of your competitors you have to keep improving in all segments, including: fuel efficiency, organizing your team, getting new solutions on time (like ELD’s), meeting the compliances and much more.

Financing your trucking business is a big part of that process, and arguably the most critical one. Traditionally, when it comes to external financing, bank loans was the solution.

But, what if your company doesn’t have a background for their requirements? Can you really afford a time to wait for their approvals? Do you always have to increase your debt to get funds?

Getting bank loans seems to be far from ideal option, doesn’t it?

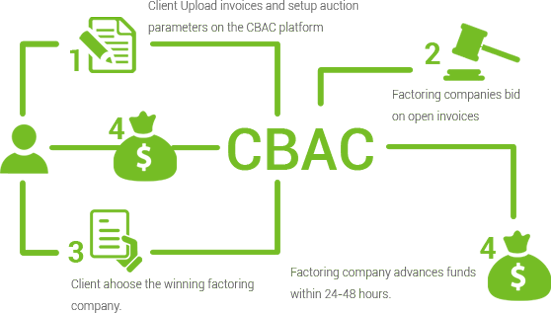

Fortunately, there is a way, and a damn good one, for making a cash flow problems flourished. It’s called freight bill factoring.

But, let’s take a look before we leap.

What Is Freight Factoring?

Put it simply, freight factoring is the easiest way to get immediate money for your freight bills. Without freight factoring you will wait for weeks or even months to get paid. You need it to avoid cash flow struggling.